A Budget Variance Occurs When Your Actual Expenses Are

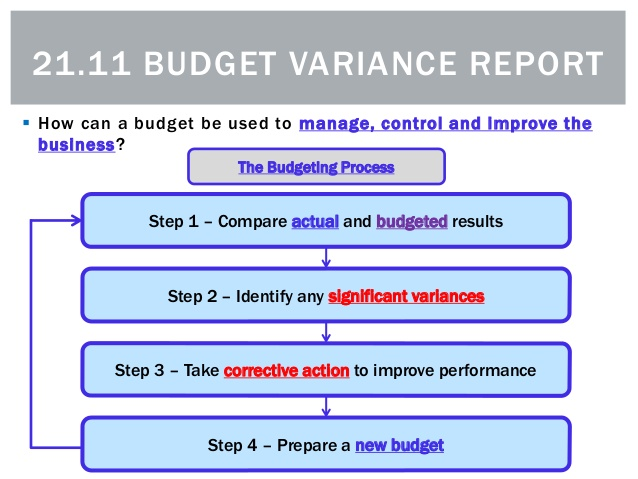

Understanding the causes of your budget variances can help you identify the business strengths or weaknesses and develop solutions when needed. Meaning actual revenue that was more than expected or actual expenses or costs that were less than expected.

A Monthly Budget Variance Report Ppt Download

What are your work related expenses.

. A budget variance is the difference between the budgeted or baseline amount of expense or revenue and the actual amount. Budget variance deals with a companys accounting discrepancies. An unfavorable budget variance describes negative variance meaning losses and shortfalls.

Budget variances occur because forecasters are unable to predict future costs and revenue with complete accuracy. Errors changing business conditions and unmet expectations. Budget variance is a periodic measure used by governments corporations or individuals to quantify the difference between budgeted and actual figures for a particular accounting category.

Actual expenses are lower than the budgeted expenses. By contrast unfavourable or negative budget variance occurs when. The budget variance is favorable when the actual revenue is higher than the budget or when the actual expense is less than the budget.

An unfavorable budget variance is well the opposite. A budget variance occurs when your actual expenses are. Budget variances are a common feature in financial reporting occurring when actual revenue or expenses are higher or lower than your budgeted figures.

There are three primary causes of budget variance. A budget variance represents a difference between the amount a business or individual budgeted for and the actual amount they spent or earned. A favorable budget variance refers to positive variances or gains.

Occurs when actual spending is greater than planned spending. A variance from the budgeted amounts. The difference between the actual spending category and the budgeted amounts category.

For example if your budgeted expenses were 200000 but your actual costs were 250000 your unfavorable variance would be 50000 or 25 percent. All of the above PS. The budget variance is favorable when the actual revenue is higher than the budget or when the actual expense is less than the budget.

Actual sales are greater than budgeted sales. It is not b which I thought was the correct answer. There are a number of reasons for this including faulty math using the wrong assumptions or relying on stalebad data.

Actual revenue is lower than expected. What are your goals. A financial planner is trained to help people with advice about how to invest.

The term wants refers to items people desire for reasons beyond survival and basic comfort. Budget variances can occur broadly due to either controlled or uncontrollable. The negative variance can also sometimes refer to a discrepancy in budgeting for assets and.

This example indicates that there are problems with the entitys estimate of its operating expenses with the majority of the actual expenses resulting in an unfavourable variance compared to. A budget variance occurs when your actual expenses are. Less than more than different all of the above.

A budget variance occurs when your actual expenses are _____ than your budgeted expenses. Budget variance equals the difference between the budgeted amount of expense or revenue and the actual cost. An example is when a company fails to accurately budget for their expenses either for a given project or for total quarterly or annual expenses.

Often budget variances can be eliminated by analyzing your expenses and allocating an expensed item to another budget line. Since your expectations were based on knowledge from your financial history micro- and macroeconomic factors and new information if there is a variance it is because your estimate was inaccurate or because one or more of those factors changed. The term is most often used in conjunction with a negative scenario.

A favorable budget variance means that the actual amount that occurred was better for the company or organization than the amount that had been budgeted. Errors by the creators of the budget can occur when the budget is being compiled. All of the above PS.

It is not b which I thought was the correct answer. As youve seen here variances can be incredibly problematic for startups especially those with limited cash flow or without the ability to grow new revenue quickly. A budget variance 1 occurs when the actual results of your financial activity differ from your budgeted projections.

Favourable or positive budget variance occurs when. Since your expectations were based on knowledge from your financial history micro- and macroeconomic factors and new information if there is a variance it is. Than your budgeted expensesa.

Actual operating expenses are less than budgeted operating expenses. This means a favorable budget variance will occur when. Than your budgeted expensesa.

A budget variance A difference between the actual results of your financial activity and your expected budgeted results. In rare cases the budget variance can also refer to the difference between actual and budgeted. Basic needs include items that make life more enjoyable such as a television.

When your estimated expenses are less than your actual expenses the result is an unfavorable variance. US Government Bond Fund Chase Certificate of Deposit Money Market Mutual Funds US Series EE Savings Bond A budget variance occurs when your actual expenses are _____ than your budgeted expenses. A favorable budget variance is any actual amount differing from the budgeted amount that is good for the company.

A budget variance occurs when your actual expenses are _____ than your budgeted expenses. Actual revenue is higher than the budgeted revenue. Occurs when the actual results of your financial activity differ from your budgeted projections.

Budget Vs Actual How Budget Variances Impact Your Business

No comments for "A Budget Variance Occurs When Your Actual Expenses Are"

Post a Comment